Providing Tailored Insurance Solutions

How can I help you today?

I’m happy to walk you through your options.

GET TO KNOW ME

Provide attentive customer service throughout the southeast. Established in 2008, the agency is focused on tailoring policies to your needs. We work with a wide variety of insurance carriers in order to provide the best, most affordable insurance to as many customers as possible.

Why work with us

We are a trusted insurance agency dedicated to providing families and individuals across the Volunteer State with high-quality insurance solutions tailored to their unique needs.

Multiple carriers to choose from

Tailored options to me your needs

Seasoned team of professionals

Choice

At our insurance agency, we partner with top-rated insurers to offer comprehensive coverage tailored to your unique needs. Whether you're a business owner seeking commercial insurance or an individual looking for personal policies, our extensive network provides unparalleled options.

Experience

With more than a decade of experience, Our expert Team guides you to make informed decisions for your Personal or Business Insurance needs.

Team Work

Experience the difference of working with an insurance provider that truly cares about your well-being and peace of mind. Contact us today for unparalleled customer service and comprehensive insurance plans.

Latest addition

The Value of Home and Renters Insurance

Home and renters insurance play a crucial role in protecting us from financial losses due to unforeseen events. This case study highlights...

Read more>

Protect Your Vehicle and Finances with Auto Insurance

Auto insurance acts as a vital safety net, emphasizing the importance of purchasing comprehensive coverage to navigate unforeseen challenges on the road.

Don't leave your vehicle...

Read more>

Get instant access to the latest trends!

Newsletter, Take A Seat

About

Experience

With over a decade of experience in the insurance industry, I bring a wealth of knowledge and expertise to the table. After starting my career with Travelers in 2014, I now have the opportunity to work with multiple carriers, allowing me to provide tailored solutions that best fit your unique needs.

Commitment

I'm committed to helping you find the perfect insurance coverage that works with your budget. I take the time to understand your specific circumstances and carefully tailor the options available, ensuring you receive the most comprehensive protection at a competitive rate.If you're looking to review your current policies or explore new coverage options, I invite you to get in touch. Together, we can work together to find the ideal insurance solution that provides you with the peace of mind you deserve.

Outside of the office

I'm an avid enthusiast of music, woodworking, photography, and golf. These hobbies not only bring me joy but also foster a well-rounded perspective, enabling me to approach your insurance needs with a fresh and creative mindset.

Family

My wife Nikki and I were married in Jan of 2021 and are very grateful for your entrusting me over the years.

Worthy Cause

Giving back to our community is one of our core values. We give a portion of every sale to local charities.

The Empty Cup

Local Coffee Shop

There are millions of children literally waiting to be adopted, and the number one reason why families don’t pursue adoption is money. That’s why we created The Empty Cup. It's a space where our community can come together and give what they have to offer a tangible way to support adoption. Churches are pouring in, local businesses are pouring in, families, artists, and professionals are all pouring in—all to benefit adoption. Every single one of us has something to offer.

Transformation Ministries

Outreach as Part of Transformation

Transformation Ministries is helping bridge the gap for families in our community who may be struggling financially. Providing recourses such as food and household goods to those in need.

Second Harvest of East Tennessee

East TN Food Bank

Second Harvest Food Bank of East Tennessee is leading the community in the fight to end hunger. 202,560 East Tennesseans are at risk of hunger, uncertain where their next meal will come from. At Second Harvest Food Bank, we are working to change that statistic in 18 East Tennessee counties.

Get instant access to the latest trends!

Newsletter, Take A Seat

Recommended Devices

DashCam - Single Camera

*VIOFO Dash Cam A119 Mini 2

VIOFO dash cam A119 Mini 2 revolutionarily deploys newest STARVIS 2 IMX675 image sensor. This 2K mini dash cam can bring low noise, eliminate motion blur and shoot clearer details during day and night recording. A119 Mini 2 has a rather mini design, making it much easier to hide behind or next to the rear-view mirror. The concealed installation design won't obstruct your sight.

Water Leak Detector

*Leak Detector Sensor

Drip & Leak Alerts: Water leak detector alarm is designed with 4 rear water leakage detection probes and 2 front drip probes. There will have an alert when any of the three sets of probes were under the water. Easy to Use: No setup required, portable and easy to install without wires, can be used in every corner of your home. Loud Alarm with Mute: Our 100dB alarm is loud enough to be heard, you can clearly know where the leak occurred and deal with it in time.

Smart Water Leak Detector

*Winees WiFi Water Leak Detector

Remotely Monitoring Leaking - Connect the hub to WiFi, then monitor the water leakage in real time on the mobile APP outside; the distance between the hub and the sensor can be 200 meters, effectively monitor for water leaking events even in basement(only support 2.4G WiFi)

Air Quality Sensor

*Airthings

Airthings has mulitpe lines and products with ALWAYS-ON AIR QUALITY SENSORS: WiFi connected indoor air quality monitor measuring radon gas, PM2.5 (air pollution detector), carbon dioxide (CO2), VOCs (airborne such as kitchen gases, fumes and cleaning products), humidity, temperature, and air pressure. The monitor requires the Airthings app to function. Operating Temperature 4 to 40°C / 39 to 104°F.Sensor type: Electrochemical

Radon Monitor

*Airthings

Airthings 2911 Wave Plus, Black LTD Edition - Radon & Air Quality Monitor (CO2, VOC, Humidity, Temp, Pressure) RELIABLE RADON RESULTS: As radon levels fluctuate daily, continuous long-term measuring is necessary. Airthings Wave Plus measures radon accurately and reliably

Fire Prevention

*Ting Sensor

With years of R&D, testing, and validation behind it, Ting currently helps hundreds of thousands of homeowners across the U.S. protect their families and homes. One smart sensor sees what we can't, whether hidden behind walls, inside devices, or from utility power. Ting quietly watches over your entire home and detects hazards that lead to the most devastating fires.

*The product recommendations provided are based on personal opinions, research, and general knowledge. They are not intended as professional advice. Individual needs, preferences, and circumstances may vary, so please conduct your own research before making a purchase. We do not guarantee the accuracy, effectiveness, or suitability of any recommended products. Any purchases made through links or suggestions are at your own discretion.

Recommended Professionals

Get Referred through our Preferred Providers

Our venders referral program is about getting you the best service and a great price. We've used these venders countless times during our 11 years of services. I personally vouch for these vendors. Our clients have regularly reported they received beneficial pricing and "above and beyond service" through using our referral program

Ryan Ritter

Wisdom Insurance Network - Medicare

At Wisdom Insurance Network, our experienced team of experts is here to guide you in navigating the complexities of Medicare and life insurance. While you can view the basics of Medicare and life insurance below, we recommend reaching out to our licensed insurance agents for a more in-depth understanding tailored to your specific needs and circumstances

Dawn Titsworth

2-10 Home Buyer Warranty

Dawn Titsworth is an Account Executive for the 2-10 Home Buyers Warranty Resale Division focusing on South and East Tennessee and the Western North Carolina markets.

Dr. William Burkhart

Burkhart Direct Family Care

Restoring the Legacy Physician-Patient relationship. Hight quality, patient-centered medical care delivered directly to you swiftly with no hidden fees, costs, or barriers between you and your physician.

Inst-I-Glass

Home Glass Replacement

Inst-I-Glass of Knoxville offers drop off glass repair and replacement Mon. - Fri., with repairs often completed same-day. Whether it's a window pane or other glass piece - bring your glass to us and we'll make the repair quicker, and send you back on your way with up to 50% savings versus in-home repair.

John Cressman

Remodeling Solutions LLC - Handyman Services

Focusing on smaller jobs around the house and investment property.

Jeffrey Helie

Tree Service

No matter if you need to remove a fallen tree or schedule an overdue trim for your topiary, you can rely on the seasoned local arborists here at Monster Tree Service of Knoxville.

Integrity Construction

General Contractor

Integrity Construction Solutions is a family-owned business providing top-quality Home Remodeling Services in Knoxville, Tennessee, and surrounding areas. With a strong commitment to customer satisfaction, we offer same-day quotes and clear communication to ensure your project is completed quickly and efficiently

Phillip Fries

Metal Roofing

Experience the difference of working with an insurance provider that truly cares about your well-being and peace of mind. Contact us today for unparalleled customer service and comprehensive insurance plans.

Products

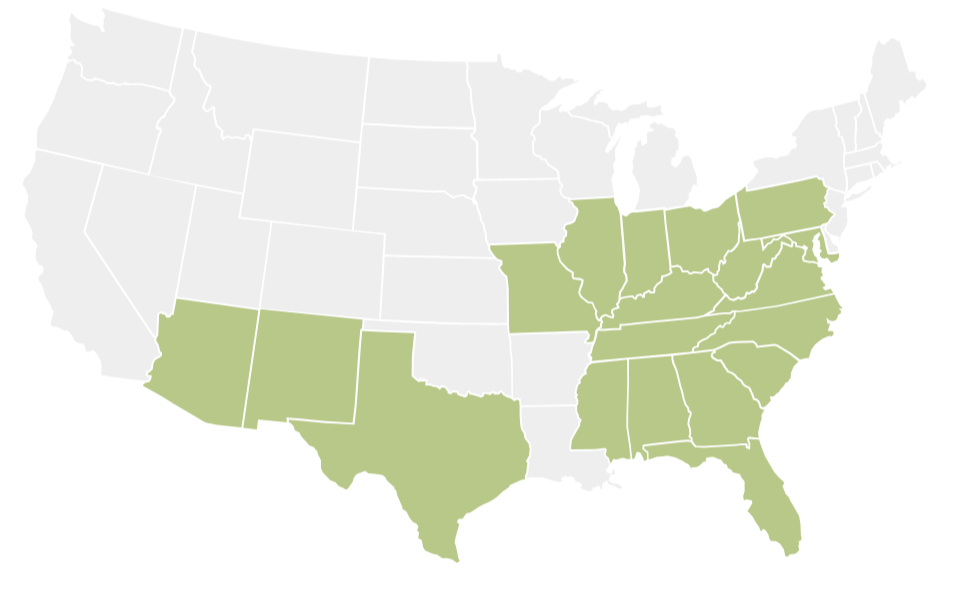

Top Insurance Agent in The Southeast

Looking for quotes on affordable insurance in Southeast? Skip the hassle of calling around and use our chat tool. Get free, fast quotes - not waiting on hold or worrying about business hours. Our chat feature makes getting quotes easy. Why waste time when our locally-focused chat can do the hard work for you? Request quotes now from top-rated Southeast providers and start saving today!

What we are about

Are you searching for reliable insurance coverage in Southeast? Look no further than Meridian Insurance. We are a trusted insurance agency dedicated to providing families and individuals across the Southeast with high-quality insurance solutions tailored to their unique needs.At Meridian Insurance, we understand that life's milestones often require adjustments to your insurance coverage. Whether you're a recent college graduate embarking on a new career, a newlywed couple starting a family, or a parent preparing to send a child off to college, our team of knowledgeable agents will work closely with you to find the perfect insurance policy.

As a leading insurance provider in Southeast, we specialize in a wide range of coverage options, including:

Auto Insurance

Homeowners Insurance

Landlord Insurance

Renters Insurance

Business Insurance

With years of experience in the

Contact Meridian Insurance today for a quote and discover how we can safeguard your future with tailored insurance policies. Experience the difference of working with a trusted insurance agency that puts your needs first.

Breakdown of Products and Coverages

The Value of Home and Renters Insurance

Home and renters insurance play a crucial role in protecting us from financial losses due to unforeseen events. This case study highlights...

Read more>

Protect Your Vehicle and Finances with Auto Insurance

Auto insurance acts as a vital safety net, emphasizing the importance of purchasing comprehensive coverage to navigate unforeseen challenges on the road.

Don't leave your vehicle...

Read more>

Contact Us

Message Us

Still have questions?

Download Contact HereYou can always reach us at:6025 Brookvale Ln Suite 208

Knoxville, TN 37919[email protected]865-455-1121Insurance Tracker

Map

Dwelling

Case Study

The Value of Home and Renters Insurance

Looking for quotes on affordable insurance in Southeast? Skip the hassle of calling around and use our chat tool. Get free, fast quotes - not waiting on hold or worrying about business hours. Our chat feature makes getting quotes easy. Why waste time when our locally-focused chat can do the hard work for you? Request quotes now from top-rated Southeast providers and start saving today!

Dwelling Insurance Case Study

Introduction

Home and renters insurance play a crucial role in protecting us from financial losses due to unforeseen events. This case study highlights the benefits of having adequate insurance coverage.

Background Information

Home insurance provides coverage for a homeowner's property and liability, while renters insurance offers similar protection for tenants renting a property.

Case Study Scenario

In this case, we follow the Smith family, who recently purchased a new home and opted for comprehensive home insurance coverage. Additionally, their friends, the Johnsons, are renting an apartment and have renters insurance.

Challenges Faced

One stormy night, a tree fell on the Smiths' roof, causing significant damage to their home. Meanwhile at the Johnsons’ apartment, a kitchen fire broke out due to faulty wiring.

Role of Home and Renters Insurance

The Smiths' home insurance policy covered the cost of repairing the roof and restoring their property. The Johnsons' renters insurance helped them replace damaged belongings and covered temporary housing while their apartment was being repaired.

Financial Impact

Without insurance, the Smiths would have faced substantial repair costs out of pocket. Similarly, the Johnsons would have struggled to replace their belongings and find alternative housing without renters insurance.

Lessons Learned

Both families realized the importance of having home or renters insurance to protect their assets and finances in unexpected situations. They now understand the value of being adequately insured.

Conclusion

This case study illustrates how home and renters insurance provide essential protection against unforeseen events, emphasizing the peace of mind and financial security they offer to homeowners and renters alike. It serves as a reminder for individuals to prioritize securing appropriate insurance coverage for their homes or rented properties.

Auto

Case Study

Protect Your Vehicle and Finances with Auto Insurance

Looking for quotes on affordable insurance in Southeast? Skip the hassle of calling around and use our chat tool. Get free, fast quotes - not waiting on hold or worrying about business hours. Our chat feature makes getting quotes easy. Why waste time when our locally-focused chat can do the hard work for you? Request quotes now from top-rated Southeast providers and start saving today!

Auto Insurance Case Study

The Client's Background

John , a busy professional living in Knoxville, TN with heavy traffic and high accident rates. Owning a car in such a congested environment exposes him to various risks, including collisions, theft, vandalism, and natural disasters – all potential causes of substantial financial burdens.

The Unfortunate Incident

One day, John's parked car fell victim to a reckless driver, sustaining severe damage to the body, engine, and other critical components. Repairing the extensive damage would cost a fortune, leaving John overwhelmed by the prospect of a significant financial strain.

The Solution: Comprehensive Auto Insurance

Fortunately, John had the foresight to invest in a comprehensive auto insurance policy from a reputable provider. His coverage proved invaluable, as it included:- Repair costs for all damages resulting from the accident

- Coverage for alternative transportation during the repair periodJohn's reasonable annual premium ensured his peace of mind and financial security. The insurance company processed his claim and facilitated the repair process efficiently, minimizing any inconvenience.

The Indispensable Safeguard

John's experience serves as a critical example of the role auto insurance plays in protecting us against unexpected events and financial liabilities associated with owner a vehicle. By purchasing the appropriate coverage, we can:

- Protect their valuable assets

- Mitigate financial risks

- Ensure continued mobility without bearing the huge repair costs

Conclusion

Auto insurance acts as a vital safety net, emphasizing the importance of purchasing comprehensive coverage to navigate unforeseen challenges on the road.

Don't leave your vehicle and finances vulnerable. Invest in top-rated auto insurance today and experience the same peace of mind and protection as John.

Big News

🔥 "Get Up to $1,200 in Annual Savings on Home & Auto Insurance — Without Switching Agents (Unless You Want To)

✅ 90% of our clients save money or get better coverage — or we donate $20 to a local charity.*

Here’s what you get:✔️ Free custom quote from 30+ top-rated insurance carriers✔️ Expert review to uncover gaps or overlaps in your current policy✔️ No agent switch required — unless you find something better✔️ Bonus: FREE home security tips checklist to lower your premium even more👉 Click below to see if you qualify in 60 seconds — no credit check, no spam.*Donations are completed at the end of each pay cycle

Home Security Tips to Help Lower Your Insurance Premium

Small changes = Big savings. Here are quick, affordable ways to secure your home and potentially lower your insurance cost.

🏠 1. Install Deadbolt Locks on All Exterior Doors

- Insurers love simple security upgrades.

- Choose Grade 1 or 2 deadbolts for maximum credit.📹 2. Add a Smart Security Camera or Video Doorbell

- Products like Ring or Nest deter theft and package loss.

- Some carriers offer discounts just for having it installed.🚨 3. Use a Monitored Alarm System

- Systems monitored by services like ADT, Brinks, or SimpliSafe often qualify for insurance credits.

- Ask your insurer if self-monitored systems qualify too.🔥 4. Install Smoke & Carbon Monoxide Detectors

- Ensure every level and sleeping area is covered.

- Test monthly and change batteries every 6–12 months.🧯 5. Keep a Fire Extinguisher Accessible

- Especially in the kitchen and garage.

- Make sure it’s rated ABC for all fire types.💧 6. Add Smart Water Leak Detectors

- Devices like Smart Water Leak Detector or YoLink sensors can prevent water damage and lead to significant premium savings. Find them here🔐 7. Lock Sliding Doors with a Security Bar

- Simple, $10 fix that prevents forced entry.

- You can also install anti-lift devices for bonus protection.🕒 8. Use Timers for Lights When You’re Away

- Create the illusion that someone is home.

- Some smart plugs allow remote control via app.✅ 9. Recommended Device to Save More & Protect What Matters.

Want an easy win that can help lower your insurance premium and protect your family?👉 Check out our recommended home protection devices here.

These tools can increase your eligibility for discounts while giving you greater peace of mind.📞 10. Notify Your Agent After Any Upgrade

- Got a new security system or smart lock?

- Let your insurance agent know — it could lower your rate immediately.💡 Pro Tip: Bundling home + auto can add another 10–25% in savings.Want a personalized quote that includes these discounts?👉 Take the 60-Second Savings 🔗Check now

Get a Customized Quote Today

Are you searching for reliable insurance coverage in Southeast? Look no further than Meridian Insurance. We are a trusted insurance agency dedicated to providing families and individuals across the Southeast with high-quality insurance solutions tailored to their unique needs.At Meridian Insurance, we understand that life's milestones often require adjustments to your insurance coverage. Whether you're a recent college graduate embarking on a new career, a newlywed couple starting a family, or a parent preparing to send a child off to college, our team of knowledgeable agents will work closely with you to find the perfect insurance policy.

As a leading insurance provider in Southeast, we specialize in a wide range of coverage options, including:

Auto Insurance

Homeowners Insurance

Landlord Insurance

Renters Insurance

Business Insurance

With years of experience in the

Contact Meridian Insurance today for a quote and discover how we can safeguard your future with tailored insurance policies. Experience the difference of working with a trusted insurance agency that puts your needs first.

Website & Content Disclaimer

Disclaimer

Informational statements regarding insurance coverage are for general description purposes only. These statements do not amend, modify or supplement any insurance policy. Consult the actual policy or your agent for details regarding terms, conditions, coverage, exclusions, products, services and programs which may be available to you. Your eligibility for particular products and services is subject to the final determination of underwriting qualifications and acceptance by the insurance underwriting company providing such products or services.This website does not make any representations that coverage does or does not exist for any particular claim or loss, or type of claim or loss, under any policy. Whether coverage exists or does not exist for any particular claim or loss under any policy depends on the facts and circumstances involved in the claim or loss and all applicable policy wording.

Get a Customized Quote Today

Privacy Policy

What information do we collect?

We collect information from you when you fill out a form. You may be asked to enter your name, e-mail address, mailing address or phone number. You may, however, visit our site anonymously.What do we use your information for?

Any of the information we collect from you may be used in one of the following ways:To process transactions

Your information, whether public or private, will not be sold, exchanged, transferred, or given to any other company for any reason whatsoever, without your consent, other than for the express purpose of delivering the purchased product or service requested.To send periodic emails

The email address you provide will only be used to send you information and updates pertaining to the request you submitted online.How do we protect your information?

We implement a variety of security measures to maintain the safety of your personal information when you place an order or access your personal information.Do we disclose any information to outside parties?

We do not sell, trade, or otherwise transfer to outside parties your personally identifiable information. This does not include trusted third parties who assist us in operating our website, conducting our business, or servicing you, so long as those parties agree to keep this information confidential. We may also release your information when we believe release is appropriate to comply with the law, enforce our site policies, or protect ours or others rights, property, or safety. However, non-personally identifiable visitor information may be provided to other parties for marketing, advertising, or other uses.Third party links

Occasionally, at our discretion, we may include or offer third party products or services on our website or one of our blogs. These third party sites have separate and independent privacy policies. We therefore have no responsibility or liability for the content and activities of these linked sites. Nonetheless, we seek to protect the integrity of our site and welcome any feedback about these sites.Childrens Online Privacy Protection Act Compliance

We are in compliance with the requirements of COPPA (Childrens Online Privacy Protection Act), we do not collect any information from anyone under 13 years of age. Our website, products and services are all directed to people who are at least 13 years old or older.Your Consent

By using our site, you consent to our privacy policy.Changes to our Privacy Policy

If we decide to change our privacy policy, we will post those changes on this page.Contacting Us

If there are any questions regarding this privacy policy you may contact us.

Get a Customized Quote Today

Service Center

Claims & Payments

Payment and claim information is available below for the insurance companies we represent. If you are having trouble reaching your insurance company or have questions, please feel free to contact us directly.

Submission Form & Phone Numbers Below